We’re Not Willing to Tax Florida’s Future Away

Florida is fortunate to be home to 19 Fortune 500 companies – employers that are directly producing thousands of private-sector jobs, playing a strong role in Florida’s vibrant economy, paying and collecting billions in taxes and contributing their time, talents and resources to many of Florida’s philanthropic organizations who then put hundreds of millions of dollars into helping those who can’t help themselves.

Yet once again, these job creators are under attack. They are the “boogie man” for activist journalism which, far too often, seeks to advance socialism over free enterprise – apparently for more clicks, likes and retweets.

Only in America could the distorted tax policy theory espoused by some at the Orlando Sentinel become a headline. And in a news cycle that rarely provides transparency for both sides of an issue, it’s forcing more and more job creators like FedEx Chairman and CEO Frederick W. Smith to take a more challenging approach to respond when the facts don’t fit a newspapers planned narrative.

As the late great Paul Harvey would say, “Now here’s the rest of the story.”

In uniting the business community for good, the Florida Chamber is shining a light on bogus, socialist-style reports that use half-truths and innuendoes in an attempt to somehow tarnish leading job creators (a system that has Florida creating one out of 13 new U.S. jobs).

Thanks to Florida job creators, Florida’s unemployment levels are lower than the national average.

Families and businesses in high tax states like New York, Connecticut, New Jersey, Illinois, and California are fleeing their states for lower tax climates that allow families to save for a rainy day, businesses to hire more employees or reinvest in their facilities, and to create an overall better quality of life. These high-tax states apparently believe government creates jobs, when we all know that the private sector creates the jobs and the paychecks that are used to buy things that, in turn, create taxes that fund our government.

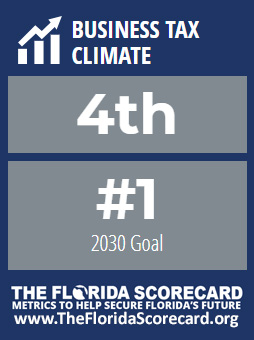

It’s true that Florida has the fourth best tax climate in the country. That’s because, unlike in high-tax states, Florida’s corporate income tax reporting doesn’t mandate “combined reporting.” While that reporting style is favored by those that want to see Florida fail, it has not been roundly supported by Florida’s own economists. In fact, Florida’s own economic forecasters have said combined reporting won’t increase tax revenue, and in fact, have gone on record to say it could actually decrease revenue collections during the next economic downturn – something Florida’s education system, environment and transportation systems can’t afford.

That’s not an economic forecast we’re willing to stake Florida’s future on.

Growing Florida’s economy from the 17th in the world to the 10th largest on the planet means ensuring global competitiveness, prosperity and high paying jobs, and vibrant and resilient communities. A competitive and equitable tax system that encourages job growth and strengthens our economy will be essential in achieving this goal.

That means the Florida Chamber will once again unite businesses in Florida’s Capitol and fight for further reducing the corporate income tax, phasing out the business rent tax, leveling the online sales tax playing field, increasing the R&D tax credit to spur innovation, reducing the communications services tax and fixing Florida’s lawsuit abuse tax.

With 4.5 million more people expected to call Florida home by 2030, we will continue to ensure Florida is a state where jobs provide Floridians an opportunity to prosper. And we will fight for free enterprise to lead the way.

For the last decade, lawmakers have been returning hard earned tax dollars back to Floridians – through targeted tax savings like back-to-school sales tax holidays and reductions in the corporate income tax. Yet, Florida’s tax receipts continue to grow.

As Ronald Reagan used to say, if you want less of something, tax it. With all due respect to the Orlando Sentinel, we’re not willing to tax Florida’s future away.

Two Ways You Can Help:

- Sign the Petition to create a competitive and equitable tax system.

- Join us for the Florida Chamber’s premier legislative event, our 2020 Legislative Fly-In, and connect with legislators, state leaders and Florida’s top business leaders who want free enterprise to succeed.

November 20, 2019