Florida SBDC, SBA to open Mobile Business Recovery Centers in Bradenton

Florida SBDC Network – Small businesses in Manatee County impacted by Hurricane Ian will be able to receive help applying for state and federal disaster loans at temporary Mobile Business Recovery Centers opening in Bradenton.

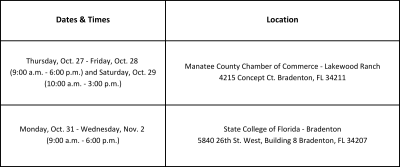

The Florida Small Business Development Center (SBDC) Network and the U.S. Small Business Administration (SBA) will open temporary Mobile Business Recovery Centers (BRC) this week and next at the following locations:

At these locations, Florida SBDC at USF and SBA disaster specialists will be available to help impacted small business owners understand available state and federal disaster loans, determine eligibility, and apply.

“We are saddened to see and hear the stories of damage and loss that small businesses in our state have suffered,” said Greg Britton, state director of the Florida SBDC Network. “We want small businesses to know we’re here to help and are committed to their recovery.”

Carl Hadden, regional director of the Florida SBDC at USF, added, “I am proud of the way our Florida SBDC at USF team has stepped up to meet the needs of businesses impacted by Hurricane Ian. During times of disaster, we work alongside our partners at the SBA to provide business owners with information, resources, and encouragement to help rebuild and reopen their businesses.”

At the state level, the Florida Department of Economic Opportunity (DEO) has activated the Florida Small Business Emergency Bridge Loan (EBL) Program. The loan program provides short-term, zero-interest loans to small businesses who experienced economic injury or physical damage due to Hurricane Ian.

Loans approved through the Emergency Bridge Loan Program are intended to “bridge the gap” between the time a disaster impacts a business and when a business has secured longer term recovery funding, such as federally or commercially available loans, insurance claims, or other resources.

Eligible small businesses with two to 100 employees may apply for loans of up to $50,000 through the program. Businesses must also be located in Florida, have been established prior to September 24, 2022, be located in an eligible county, must have been economically or physically damaged by Hurricane Ian, have a credit score of 600 or above, and must have repaid all outstanding EBLs.

Marine Fisheries Industry sole proprietors with businesses located in Charlotte, Collier, DeSoto, Hardee, Lee and Sarasota counties are also eligible to apply, but must provide documentation demonstrating the business is part of the Marine Fisheries Industry.

Low-interest Business Physical and Economic Injury Disaster Loans from the U.S. Small Business Administration (SBA) are also available to eligible businesses following the announcement of a Presidential disaster declaration beginning Sept. 23.

Businesses and private nonprofit organizations of any size may borrow up to $2 million to repair or replace disaster-damaged or destroyed real estate, machinery and equipment, inventory, and other business assets.

For small businesses, small agricultural cooperatives, small businesses engaged in aquaculture and most private nonprofit organizations, the SBA offers Economic Injury Disaster Loans to help meet working capital needs caused by the disaster. Economic Injury Disaster Loan assistance is available regardless of whether the business suffered any physical property damage.

Business recovery centers are also available in the following counties for impacted businesses to receive assistance: Hillsborough, Lee, Seminole, Collier, and Charlotte.

For more information on state and federal disaster loans, BRC locations, and how the Florida SBDC Network can help, please visit www.FloridaSBDC.org/disaster.