Creating Florida Jobs Through Marketing

There is a general misunderstanding of how to quantify the benefits that accrue to the state of Florida from marketing expenditures. Many economic studies exist, yet the general population and many state legislators are seeking answers to the question of whether our state receives benefits from marketing programs at a level higher than amounts expended. By looking at existing studies of returns to the state of Florida from marketing efforts by VISIT FLORIDA, this will serve as an example of how benefits of a consistent marketing effort are calculated, how the effect on job creation can be quantified, and how Florida’s return on investment can be analyzed. Important to note is that these effects are for visitors either from out of state or out of the country – the vacation trips made by Floridians in our state are not considered when visitor numbers are calculated.

A recent paper from Florida’s Office of Economic & Demographic Research (EDR) published in January 2015 along with other studies will allow us to look at both the state’s financial returns and other returns to marketing programs, using tourism marketing as an example. Results from multiple papers, along with economic theory, will help policymakers understand not only the direct benefits to state tax receipts, but also the other benefits received from a successful multi-year marketing program.

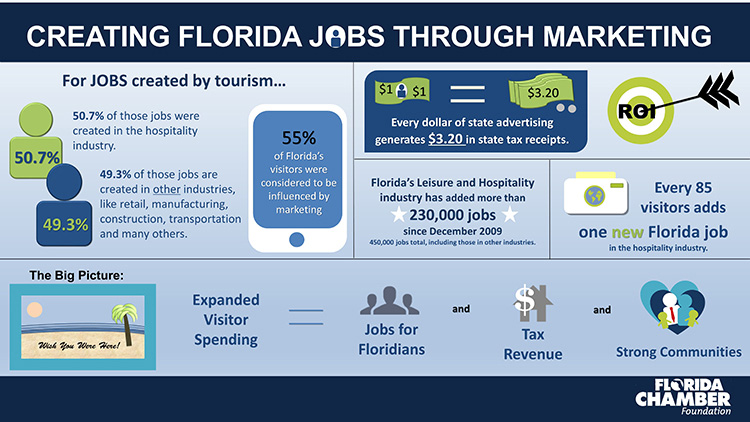

The EDR analysis showed that the return on investment (ROI) to VISIT FLORIDA’s marketing spend was positive, returning $3.20 to state tax receipts for every $1.00 of state advertising expenditures. One of the benefits noted in the study is that spending by tourists generally stays in the local economy. Another important note from the paper is that much of the return to the state is provided by sales taxes on items that tourists purchase. What is clear is that this study was professionally done, using a conservative methodology that allocates only a small percentage of visitors’ spending to marketing efforts of VISIT FLORIDA.

As an example, for the year 2013 just less than 52 million of the almost 94 million visitors were considered influenced by marketing. Of the 52 million visitors, the conservative amount of 5.54 million was attributed to VISIT FLORIDA marketing efforts. Therefore, the study’s results of an increase in state tax revenues of $3.20 to the state for every dollar of VISIT FLORIDA marketing spending came from less than 6 percent of the total visitors during that time period.

If we quantify the total benefits to Florida from this successful marketing program, some of the things that should be added are the job creation benefits and the resultant increase in state tax collections, plus the additional tax receipt increases at the local government level that come from both tourists and additional people working in the economy due to the expansion of tourism.

Effect on Jobs

What we know is that increased tourism marketing dollars provided by the Florida Legislature is highly correlated with raising the number of Florida visitors to record levels. We also know that increasing the number of visitors to Florida causes companies to hire more workers in the Leisure and Hospitality industry. This relationship is very consistent, averaging one direct hospitality industry job for every 85 visitors. What we also know is that additional spending by visitors and the increase in jobs creates a substantial amount of indirect and induced jobs. Indeed, recent research has shown that when visitor numbers increase, there are nearly as many indirect and induced jobs created as there are direct jobs with a ratio of just under one-to-one.

Of the total expected job creation caused by increased visitor expenditures, the private, non-farm jobs created in non-hospitatlity categories are expected to be 49.3% of the total. What is important about this statistic is that we must include the economic benefits accrued to the state from the indirect and induced jobs as well as the direct jobs in order to get a full accounting of the benefits from marketing programs.

The chart shows the increases in the Leisure and Hospitality category from December 2009, the lowest level during the Great Recession, through the present. Starting at the recession low of 913,800 the number has grown to more than 1.14 million during this time of expanded tourism marketing. Interesting to note that Leisure and Hospitality data is a subset of the entire set of “tourism jobs”, because this category doesn’t include jobs often counted in “tourism jobs” such as air transportation and reservation services, which are directly affected by increases in tourism.

The Bureau of Labor Statistics job numbers indicate that Leisure and Hospitality has expanded by 232,800 jobs during the recovery from the recession. That indicates an increase of more than 25 percent in this category alone. When we apply the estimated increase of 226,370 indirect and induced jobs to the Leisure and Hospitality job numbers, the estimated total jobs created becomes 459,170 since the bottom of the recession. Those indirect and induced jobs are in a variety of categories, including retail trade, administrative and waste management services, construction, transportation and warehousing, and several other categories. Although not estimated in this paper, the state tax receipts from this increase in jobs is substantial, and would significantly increase the estimates of the return to the investment in tourism marketing if they were included.

Effect on Local Government Revenues

Many local government tax receipts increase when tourism and employment increase. Local option sales taxes, tourist development taxes, transient rental (bed taxes), and ad valorem taxes on property are just some of the tax receipts that go higher when more tourism activity occurs and employment expands. Perhaps one of the most overlooked is the increases in ad valorem taxes due to significantly higher values of hotels and resort properties in our state. As the visitor numbers have increased, the yield to hotels has increased substantially. This increase in yield increases the taxable values of hotel and resort properties. When property values increase, so do ad valorem tax receipts – which are important not only for paying for local government services such as law enforcement, but also because ad valorem tax receipts are a substantial amount of funding for schools in Florida.

Adding It Up

It is unlikely that Floridians think a lot about all the positive economic effects that expanding tourism marketing has caused. Besides the direct effects of increases in hospitality industry employment and increases in sales tax receipts for the state – the indirect and induced jobs that have been created are substantial. Also substantial are the taxes collected from sources other than sales tax – including bed taxes, which are collected and used by counties for advertising and promotion, for beach and shoreline restoration, and other local purposes.

The percentage of taxes that Florida visitors pay is a complex calculation. The office of Economic and Demographic Research estimated that visitors from outside our state paid an estimated $2.457 billion in state sales taxes during the 2013-14 Fiscal Year. This is nearly 12.5 percent of all state sales taxes collected during that period. When local option sales taxes, property taxes, and all the other tax receipts which are paid by those visiting Florida from out of state or from other countries are calculated, the overall percentage will be substantially higher. Those taxes contribute to both the state and local economies, paying for necessary services for Florida residents.

Florida’s tourism marketing budget has increased, and Florida visitation has increased substantially over the last 5 years, to an estimated 101.7 million visitors during the 2014-15 fiscal year. This has been accompanied by a rise in total room revenue of $12.9 billion – a 12.4 percent increase over the previous fiscal year. Although final numbers for tourism spending have not been released, estimates are that tourism and travel spending are more than $80 billion during the same time period. Substantial increases in tourism spending have been achieved by using targeted marketing to bring in more international visitors who stay longer and spend more in our state.

As Florida plans for its future, continuation of this type of successful marketing is one way we can continue to create more jobs, provide more opportunities for Floridians, and pay for services without increasing taxes on our residents.

For information on the report findings, contact Jerry D. Parrish, Ph.D., Chief Economist and Director of Research, Florida Chamber Foundation at jparrish@flfoundation.org.